Family Office Wellness

Engagement Overview

Our integrated approach delivers the difference for family office clients .The purpose of this overview is to provide a summary of the Family office wellness offering,services and insights to understanding your strategy and how it is being executed

Current state

Baseline assessment of

structure and protfolio

Investment objectives

Alignment with vision and

values,future-proof legacy

Performance to plan

Resource gaps plans to

actual and roadmap

Implement

Baseline assessment of

structure and protfolio

Creating a successful Family Office requires strategic planning and design.With our focus on Family Office worldwide,we can facilities optimal outcomes where a strong alignment in strategic objectives existsCreating a successful Family Office requires strategic planning and design.With our focus on Family Office worldwide,we can facilities optimal outcomes where a strong alignment in strategic objectives existsFamily businesses have the characteristics and capabilities needed to claim the sweet spot where competence and ethics converge,personal values and business purpose drive decisions,and long-term sustainable outcomes are non-negotiables.

we provide a holistic diagnostic that reviews strategic planning,services provided,processes controls,technology and Family Office glovernance.Our recommendations support your family’s legacy,improving efficiency and reducing the family risk.

Our integrated approach delivers the difference for family office clients .The purpose of this overview is to provide a summary of the Family office wellness offering,services and insights to understanding your strategy and how it is being executed

Current state

Baseline assessment of

structure and protfolio

Investment objectives

Alignment with vision and

values,future-proof legacy

Performance to plan

Resource gaps plans to

actual and roadmap

Implement

Baseline assessment of

structure and protfolio

Creating a successful Family Office requires strategic planning and design.With our focus on Family Office worldwide,we can facilities optimal outcomes where a strong alignment in strategic objectives exists

Creating a successful Family Office requires strategic planning and design.With our focus on Family Office worldwide,we can facilities optimal outcomes where a strong alignment in strategic objectives exists

Creating a successful Family Office requires strategic planning and design.With our focus on Family Office worldwide,we can facilities optimal outcomes where a strong alignment in strategic objectives exists

Family businesses have the characteristics and capabilities needed to claim the sweet spot where competence and ethics converge,personal values and business purpose drive decisions,and long-term sustainable outcomes are non-negotiables.

we provide a holistic diagnostic that reviews strategic planning,services provided,processes controls,technology and Family Office glovernance.Our recommendations support your family’s legacy,improving efficiency and reducing the family risk.

we’re a boutique firm partnering with Family Offices for over 30 years.Our global reach and local focus allows

us to come to you, wherever we’re needed,with the skills and experience required to add tangible value.

Australia

Level 3, 102 Adelaide street Brisbane 4000

Hong kong

Lippo centre, 89 Queensway Admiralty

Bahamas

Marlborough & Queen streets Nassau N-3026

Uruguay

Avda.de las Americans 8000 Parque Miramar,Canelonnes 14.000 Montevideo

We bring the know-how from Winterbotham who specialise in multi-generational wealth management and cross-border structuring

Our strategy practices has a proven track record in developing and implementing strategies and delivering optimal outcomes for Family Offices, family businesses,listed and unlisted companies

We offer bespoke solutions based on the specific situation,jurisdition and needs of the family.

We provide access to an ‘evergreen’ global ecosystem – linknig you to a cohort of Family Offices and associated businesses and investment opportunities worldwide

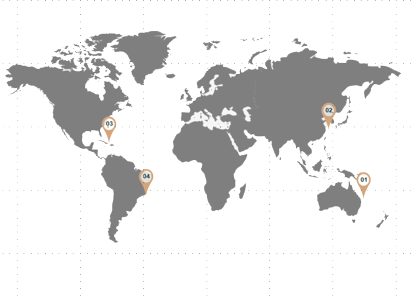

Wealth

In today’s increasingly complex global financial ecosystem,owners of successful family business require a comprehensive strategy to manage,protect and grow their wealth,not just for themselves but also for future generations.

Legacy

Family businessses have a long-term prespective and often think in terms of generations,rather than quarters. For this reason,achieving a smooth and well-managed succession to the next generation of the owning family is critical to ensure the long-term success of the bussiness.

Purpose

By leveraging their purpose and values,family businesses can create a distinct brand identity that resonates with their customers and differentiates them from their competitors.

Impact

Investing your wealth in a manner that aligns with your core values not only generates financial returns but also leads the way in solving societal issues and creates a lasting legacy for future generations.

Comprises four phase review,with collaboration at the core of how we will work with you and your stakeholders.

1. CURRENT STATE

To confirm the objectives and

scope of the review, get up to

speed on existing business and

thinking, and draw lessons

from similar organisations

- Project kick-off: initial

meetings to confirm scope

of the review - Documentation review:

review existing documents

and identify risks and gaps

relating to scope, process

and delivery

2. INVESTMENT OBJECTIVES

To co-develop investment

objectives and alignment with

vision and values, bringing buy-

in and expertise from across the

organisation

- Learnings and best

practice: conduct a rapid

review of similar

organisations drawing out

lessons, risks and best

practices - Capital requirements:

including capital to deploy.

deal-flow and ROI objectives - Initial recommendations:

incorporate feedback from

workshops and develop an

initial set recommendations

for testing with executives

3. IMPLEMENT

To formalise findings with an

actionable plan to manage and

monitor the roadmap to the

target state

- Draft and final report: draft

report detailing

recommendations from the

strategic review outlining

critical recommendations.

Final report prepared

incorporating comments

from stakeholders - Delivery considerations:

Identify delivery

considerations and undertake

strategic risk review and

identify governance and

mitigation approaches

4. PERFORMANCE TO PLAN

To identify any resource gaps,

socialise recommendations with

your key stakeholderss

- Roadmap to target state: performance to plan with

clearly defined solutions

that will drive measurable

performance improvement - Executive briefing:

we will

augment key content from

our final report into a

succinct and executive

briefing pack and present key

recommendations to your

stakeholders

Regular meetings and ongoing stakeholder consultation

Governance and accountability

Some Multi-Family Offices are not able to clearly state individual roles and

responsibilities, particularly global groups, and a very common observation from our

wellness review indicates suboptimal allocation of roles and responsibilities

Wealth strategy

No clear Family Office strategy, optimising outcomes across Wealth, Impact, Legacy

and Purpose

Indequate record keeping

Limited policies and procedures covering the steps required for taking on different

investor types, some Family Offices do not collect all the documents required for KYC

or professional investor assessment purposes

Deficiencies in portfolio valuations

The valuation of a portfolio company requires a great deal of professional judgement

because market prices are not available. It is important that Family Offices make sure

that they keep records showing how the valuations were derived. If third party service

providers are used, Family Offices need to regularly review the valuation services and

assumptions

Insufficient record of investment horizon

Family Offices generally have a very long-term investment horizon, but we do find

that their investment managers have often not kept records which show that they

have carefully considered the investment horizon as part of the suitability

assessment

Insufficient record of investment horizon

Family Offices generally have a very long-term investment horizon, but we do find

that their investment managers have often not kept records which show that they

have carefully considered the investment horizon as part of the suitability

assessment

Deficiencies in portfolio valuations

The valuation of a portfolio company requires a great deal of professional judgement

because market prices are not available. It is important that Family Offices make sure

that they keep records showing how the valuations were derived. If third party service

providers are used, Family Offices need to regularly review the valuation services and

assumptions

Indequate record keeping

Limited policies and procedures covering the steps required for taking on different

investor types, some Family Offices do not collect all the documents required for KYC

or professional investor assessment purposes

Wealth strategy

No clear Family Office strategy, optimising outcomes across Wealth, Impact, Legacy

and Purpose

Governance and accountability

Some Multi-Family Offices are not able to clearly state individual roles and

responsibilities, particularly global groups, and a very common observation from our

wellness review indicates suboptimal allocation of roles and responsibilities

Ivan

Hooper

CEO WINTERBOTHM

-

+1242 376 3455

-

ihooper@winerbotham.com

-

Marlborough & Queen st,Nassau,N3026,Bahamas

-

www.winterbotham.com

Kathrin

Mutinelli

MANAGING DIRECTOR

-

+614 1717 0301

-

kathrin@seventytwo.au

-

Level 3, 102 Adelaide street Brisbane CBD 4000

-

www.seventytwo.au

Lucas

Zorzo

DIRECTOR,CORPORTE FINANCE